OR Freddie Mac / Fannie Mae 3038 2001-2026 free printable template

Show details

After Recording Return To: Space Above This Line For Recording Data DEED OF TRUST DEFINITIONS Words used in multiple sections of this document are defined below and other words are defined in Sections

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oregon deed trust form

Edit your trustee property title form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how do you transfer a appears on the new deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trustee deed online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oregon deed of reconveyance form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust deed oregon form

How to fill out OR Freddie Mac / Fannie Mae 3038

01

Obtain the OR Freddie Mac / Fannie Mae 3038 form from the official website or your lender.

02

Carefully read the instructions provided with the form.

03

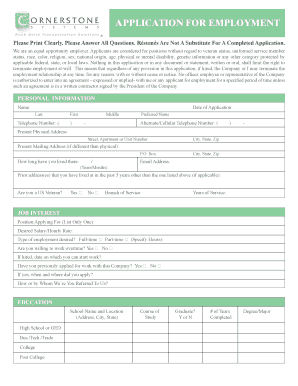

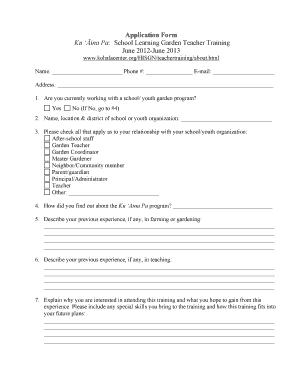

Fill in your personal information, including your name, address, and contact details at the top of the form.

04

Provide information about the loan being applied for, including the loan amount and purpose.

05

Include details about the property, such as the address and type of property.

06

Complete the financial information section, detailing assets, liabilities, and income.

07

Review all entries for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form to your lender or broker as instructed.

Who needs OR Freddie Mac / Fannie Mae 3038?

01

Individuals or families applying for a mortgage loan.

02

Real estate professionals assisting clients with mortgage applications.

03

Lenders who require standardized documentation for processing loan applications.

Fill

deed of trust oregon

: Try Risk Free

People Also Ask about

Does a trust deed in Oregon need to be recorded?

The Oregon Trust Deed Act (OTDA) requires lenders to record all deed of trust assignments before initiating nonjudicial foreclosures.

What is a form of deed of trust in Oregon?

An Oregon deed of trust is a contract in which the title to one's real estate is assigned to a third-party trustee to provide security (collateral) for a home loan. The security is held by the trustee throughout the term of loan repayment.

Why would you use a deed of trust?

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

How do you transfer a deed to a trust in Oregon?

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Does Oregon use deed of trust or mortgage?

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

Does Oregon use trust deeds?

The Oregon Trust Deed Act was established in 1959 to make the foreclosure process easier and faster by not involving the courts. The Act allows the lender to file a trust deed, which assigns the deed to a third-party (trustee).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my OR Freddie Mac Fannie Mae 3038 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your OR Freddie Mac Fannie Mae 3038 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify OR Freddie Mac Fannie Mae 3038 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including OR Freddie Mac Fannie Mae 3038, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Can I sign the OR Freddie Mac Fannie Mae 3038 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your OR Freddie Mac Fannie Mae 3038 in minutes.

What is OR Freddie Mac / Fannie Mae 3038?

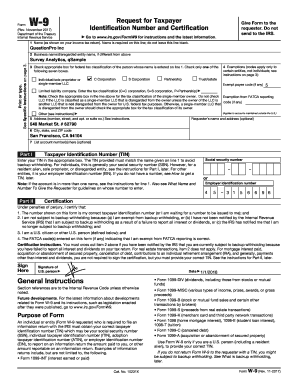

OR Freddie Mac / Fannie Mae 3038 is a form used by lenders to report information related to mortgage loans that are sold or purchased by Freddie Mac or Fannie Mae.

Who is required to file OR Freddie Mac / Fannie Mae 3038?

Lenders who sell or purchase mortgage loans through Freddie Mac or Fannie Mae are required to file OR Freddie Mac / Fannie Mae 3038.

How to fill out OR Freddie Mac / Fannie Mae 3038?

To fill out OR Freddie Mac / Fannie Mae 3038, the lender must provide information about the loan, including borrower details, loan amount, property address, and other relevant data as specified by the guidelines.

What is the purpose of OR Freddie Mac / Fannie Mae 3038?

The purpose of OR Freddie Mac / Fannie Mae 3038 is to ensure accurate reporting of mortgage loan transactions for compliance and record-keeping purposes in the secondary mortgage market.

What information must be reported on OR Freddie Mac / Fannie Mae 3038?

The information that must be reported includes borrower information, loan type, loan amount, property information, and transaction details related to the sale or purchase of the mortgage loan.

Fill out your OR Freddie Mac Fannie Mae 3038 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR Freddie Mac Fannie Mae 3038 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.